Evergrande Default Contagion Risk What It Means For China Sovereign And Banks

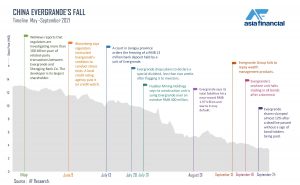

Evergrande is Chinas second-largest property firm by sales. Snowed under its crushing debt of 300 billion Evergrande is so huge that the fallout from any failure could hurt not just Chinas economy.

Explainer How China Evergrande S Debt Woes Pose A Systemic Risk Reuters

Evergrande fallout could lead to financial contagion in the Chinese economy.

Evergrande default contagion risk what it means for china sovereign and banks

. Its on-balance-sheet liabilities amount to nearly 2 percent of Chinas annual GDP and its off-balance-sheet obligations add up to as much as another 1 percent. This triggered concerns regarding its financial state and possible default. Economists at Danske Bank believe a default could trigger further contagion in Chinese. But I wanted to ask someone far from China about the situation given we have heard so much about the possibility of global contagion.For now the contagion from Evergrandes risks has not spread beyond the real estate sector in Chinas high-yield bond markets the Bank of Singapore said. Debt troubles at the property group have been dragging down global markets as investors assess the implications of a credit default. It would not only reinforce credit polarisation among homebuilders but also impact some Chinese banks with high exposure to Evergrande and other vulnerable developers. EXPLAINER-How China Evergrandes debt woes pose a systemic risk.

Evergrande Default Contagion Risk. 20 Bloomberg reported underlining the. What is the potential impact of. What It Means For China Sovereign And Banks.

Risk-off tone for APAC a USD win-win scenario bad for AUD. Currently it is scrambling to repay 305 billion to lenders suppliers and investors due to a cash crunch. Its total liability stands at 197 trillion yuan accounting for 2 percent of Chinas GDP. The risk that Evergrande would likely default on upcoming payment obligations was highlighted in September when Chinese authorities reportedly told banks.

Chinas Evergrande Implications on China Property Sector Banks and Economy - Numerous sectors could be exposed to heightened credit risk if Chinese property developer Evergrande were to default. An Evergrande default and its effect on Chinas banking sector presents a potential systemic risk to Chinas financial system since approximately 41 of the banking. Chinas Evergrande crisis. 16th September 2021 by Justin Rowe-Roberts.

In September Chinese real estate giant Evergrande missed coupon payments on two dollar bond tranches. There will always be Evergrande-type risks. The balance of the exposure is debt both onshore bank and public debt as well as offshore debt to international investors. Chinas major banks have been notified by the housing authority that Evergrande Group 3333HK wont be able to pay loan interest due Sept.

SP Global Ratings analysts held a live interactive webinar on Tuesday September 21 where they discussed the deepening China Evergrande crisis and the contagion risk to China sovereign and banks. This wouldnt be as much of a problem if Chinese property developers state-owned enterprises local governments. Evergrande is one of the biggest real estate developers in China with more than 1300 projects in over 280 cities across the mainland. Analysts have been monitoring the possibility of wider contagion in the real estate sector and larger financial systemic risks in China.

Goldmans Shan outlined several potential scenarios for Chinas economic growth from the troubles at Evergrande all of which will only stoke fears of contagion to global asset markets. Total liabilities at Evergrande are 300 billion of which 200 billion is pre-payments for housing from Chinese citizens. Key discussion points included. In terms of the secondary effects of a potential Evergrande default on Chinas banking sector the companys direct borrowings from Chinas banks is a small portion of the overall loan book of the banking sector as a whole it said.

Big banks and fund managers have been heading for the exit and reducing their exposure to China Evergrande Group in recent weeks as the outlook. The financial troubles of Chinas most indebted property developer China Evergrande Group have. The open could be in for a risk-off ride to start the week due to Chinas embattled developer Evergrande being on the. Compare this to Lehman Brothers default 600 billion of on-balance-sheet exposure as well as.

Contagion could spread to markets beyond China. Business Chinas Evergrande default risks spook global markets. Clock ticking as crucial debt default deadline looms A default by the property giant could have far-reaching consequences for China and global economy. Evergrande is the most-indebted property developer in the world.

Evergrande needs to pay interest payments on Thursday including a coupon worth USD835 M. Shares in Chinas Evergrande plunge again as fears of contagion grow This article is more than 1 month old Hong Kong stock fell up to 19 amid default fears that. One of Chinas largest property developers Evergrande is facing a liquidity crunch that could put pressure on the real estate company to continue as a going concern.

Evergrande Misses Bond Payment Even As Locals Get Partially Repaid Asia Financial News

World Stocks Tumble Over Evergrande Contagion Fears

China Developer Evergrande Debt Crisis Bond Default And Investor Risks

Evergrande Misses Bond Payment Even As Locals Get Partially Repaid Asia Financial News

Bond Issuers Evergrande Pain As Investors Eye More Security Asia Financial News

Evergrande Sparks Vortex Of Fear In China Bond Market Asia Financial News

Evergrande Misses Payment Deadline Ev Unit Warns Of Cash Crunch Euronews

Posting Komentar untuk "Evergrande Default Contagion Risk What It Means For China Sovereign And Banks"